Please carefully review the Disclaimers and Risk Factors section below.

Total asset value represents the aggregate value of all underlying properties in the Income REIT based on the most recent internal valuations as of the end of the fiscal quarter upon which our most recently announced NAV per share is based pursuant to our valuation policies provided, however, the values of properties underlying investments acquired since the most NAV per share was announced are based on the most recent purchase prices. The aggregate value of the properties underlying loans and preferred equity investments made by the Income REIT is based on independent appraisals dated within six months of the original acquisition dates by our Manager, Realty Mogul, Co. or Realty Mogul Commercial Capital, Co., as applicable. As with any methodology used to estimate value, the methodology employed by the internal accountants or asset managers of our Manager or its affiliates is based upon a number of estimates and assumptions about future events that may not be accurate or complete. For more information, see the section of our Offering Circular captioned “Description of Our Common Shares – Valuation Policies.”

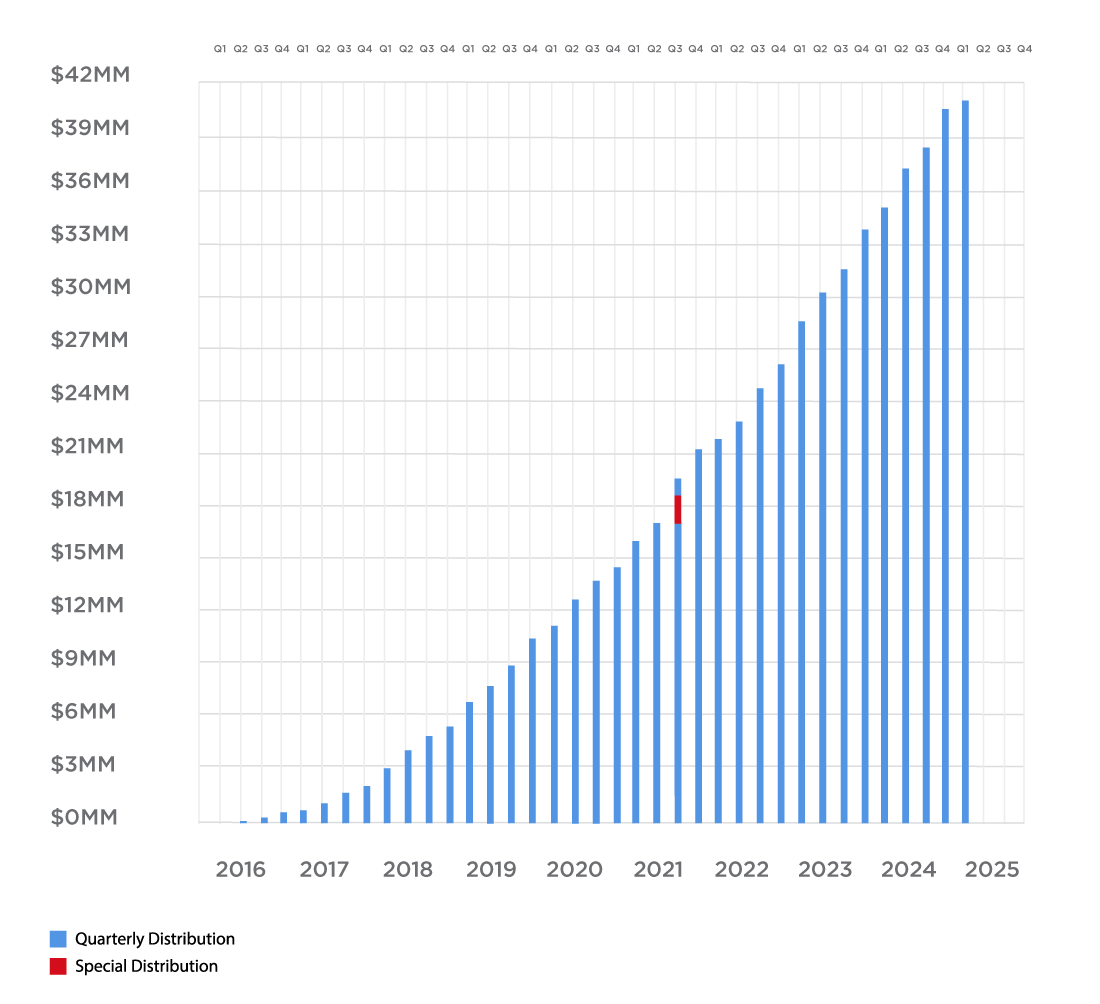

There is no guarantee that shareholders will receive a distribution, and distributions have been paid from sources other than cash flow from operations, including net proceeds from our offering, cash advances by RM Adviser, LLC, manager of the Income REIT (the “Manager”), cash resulting from a waiver of fees or reimbursements due to our Manager, and borrowings and the issuance of additional securities. The board of managers may in the future authorize lower distributions or no distributions at all for any given period.

The Income REIT's primary focus is to provide monthly income to investors by rigorously evaluating numerous investment opportunities to find those that can support the Income REIT's distribution target.

RealtyMogul's Income REIT has a minimum investment of just $5,000.

The Income REIT has:

- Paid investors an annualized cash distribution of at least 6% net of fees for ${mogulReit1DistributionDuration} consecutive months.

- Distributed a total of ${mogulReit1DistributionAmount} to investors to date.

- ${reitTotalAssetValue} in assets purchased by approximately 7,700 unique investors.2

The above chart is hypothetical and is not based on any specific client situation or outcome. This scenario should be considered for informational purposes only and should not be construed as actual performance.

The RealtyMogul Income REIT is managed by RM Adviser, LLC, a SEC registered investment adviser and wholly-owned subsidiary of Realty Mogul, Co. RM Adviser, which manages the Income REIT’s day-to-day operations, and its affiliates have access to an experienced team of real estate finance professionals employed by Realty Mogul, Co., including Jilliene Helman, its Chief Executive Officer. The team has adopted underwriting approaches used by real estate finance industry leaders in its analysis of real estate capital structures and financial strategies.

INDEPENDENT BOARD OF MANAGERS

Although the Manager, RM Adviser, LLC, manages the day-to-day operations, the Income REIT operates under the direction of its board of managers, a majority of whom are independent managers.

Other than the limited shareholder voting rights described in our offering circular, our LLC Agreement vests most other decisions relating to our assets and to the business of the Company, including decisions relating to investments, acquisitions and dispositions, the engagement of asset managers, the issuance of securities in the Company including additional common shares, mergers, roll-up transactions, conversion to a corporation, listing on a national securities exchange, and other decisions relating to our business, in our Manager, certain of which decisions our Manager has delegated to our board of managers.

REITs are legally required to distribute 90% of all taxable income to investors annually.

Generally, REITs have historically outperformed the broad stock market more often than not when returns are measured in years.** REITs have also historically been positively correlated with inflation, which may make them a possible hedge for inflation.***

**. https://www.reit.com/news/blog/market-commentary/reit-average--historical-returns-vs-us-stocks

***. https://www.reit.com/news/blog/market-commentary/how-reits-provide-protection-against-inflation

In short, the RealtyMogul Apartment Growth REIT is focused on growth investments while the RealtyMogul Income REIT is more focused on income-producing investments.

To learn more about the RealtyMogul REITs, click here.

The following third-party expense reimbursements will be paid from proceeds of the sale of the Income REIT shares:

| TYPE OF FEE | AMOUNT | NOTES |

|---|---|---|

| Organization and Offering Expenses including, but not limited to, actually incurred third-party legal, accounting, and marketing expenses.+ | Up to 3% of gross offering proceeds | NAV, at any given time, is net of Organization and Offering expenses. |

The following fees will be paid by the Income REIT to our Manager, RM Adviser, LLC, and/or its affiliates for services related to the offering, and the investment and management of our assets††:

| TYPE OF FEE | AMOUNT | NOTES |

|---|---|---|

| Asset Management Fee paid to our Manager, RM Adviser, LLC, and/or its affiliates | 1% annualized based on the “total equity value”. | For purposes of this fee, total equity value equals (a) our then-current NAV per share, multiplied by (b) the number of our common shares then outstanding. Actual amounts are dependent upon the offering proceeds we raise (and any leverage we employ) and the results of our operations and changes to our NAV. |

| Reimbursement of Other Operating Expenses paid to our Manager, RM Adviser, LLC | Variable – dependent upon operations | Includes, but not limited to, license fees, auditing fees, fees associated with SEC reporting requirements, insurance costs, tax return preparation fees, taxes and filing fees, administration fees, fees for the services of an Independent Representative or Advisory Board, and third-party costs associated with the aforementioned expenses. |

Fees Paid with Respect to Loans and Preferred Equity Only:

| TYPE OF FEE | AMOUNT | NOTES |

|---|---|---|

| Servicing Fee (Performing Loans and Preferred Equity Investments) - RM Originator, an affiliate of our Manager, RM Adviser, LLC | 0.5% of the principal balance plus accrued interest of each loan or preferred equity investments to RM Originator for the servicing and administration of certain loans and investments held by us. Servicing fees payable by us may be waived at RM Originator’s sole discretion. | Actual amounts are dependent upon the principal amount of the loans or preferred equity investments. We cannot determine these amounts at the present time. |

| Special Servicing Fee (Non-Performing Loans and Preferred Equity Investments) - RM Originator, an affiliate of our Manager, RM Adviser, LLC | 1% of the original value of a non-performing debt or preferred equity investment serviced by such RM Originator. Whether an investment is deemed to be non-performing is at the sole discretion of our Manager. | Actual amounts are dependent upon the occurrence of a debt or preferred equity investment becoming non-performing and the original value of such assets. We cannot determine these amounts at the present time. |

††There are other fees not paid by the Income REIT itself that may be paid to affiliates that originate or manage investments on behalf of the Income REIT. To learn more about our fees, estimated use of proceeds, and the Income REIT's estimated expenses, please refer to our full offering circular. Additionally, unaffiliated and affiliated third-parties will pay our Manager or affiliates of our Manager substantial fees related to the origination, investment, and management of our equity, preferred equity, debt, and fixed income assets. A portion of these fees may be paid to personnel affiliated with our Manager, including officers of our Manager, Jilliene Helman and Eric Levy. These fees reduce the amount of funds that are invested in the underlying equity, preferred equity, debt, and fixed income assets, or the amount of funds available to pay distributions to the Company, thereby reducing returns on that investment. Please carefully review the “Management Compensation” section of the Company’s Offering Circular for more information on these fees.

As is more thoroughly discussed in the Share Repurchase Program section of RealtyMogul Income REIT’s Offering Circular, after 12 months of ownership, you may request up to 25% of your eligible shares to be repurchased on a quarterly basis at the most recently announced NAV per share multiplied by the Effective Repurchase Rate, which may discount the amount you receive for your repurchased shares based on how long the shares have been held.

The Effective Repurchase Rate is based on the stock purchase anniversary as follows:

| Share Repurchase Anniversary (Year) | Effective Repurchase Rate(1) |

|---|---|

| Less than 1 year | No Repurchase Allowed |

| 1 year until 2 years | 98% |

| 2 years until 3 years | 99% |

| 3 or more years | 100% |

We intend to limit the number of shares to be repurchased during any calendar year to 5.0% of the weighted average number of common shares outstanding during the prior calendar year (or 1.25% per quarter, with excess capacity carried over to later quarters in the calendar year). In the event that share repurchase requests exceed the 5.0% annual limit of allowable repurchases, pending requests will be honored on a pro rata basis.

As of June 30, 2023, we are receiving requests for the repurchase of our shares in excess of the repurchase limit set forth in our share repurchase program. In accordance with our share repurchase program, such share repurchase requests are honored on a pro rata basis. For more information regarding our share repurchase program, see the section of our Offering Circular captioned “Description of Our Common Shares – Quarterly Share Repurchase Program."

Our REIT Manager may in its sole discretion, amend, suspend, or terminate the share repurchase program at any time. Reasons we may amend, suspend or terminate the share repurchase program include (i) to protect our operations and our remaining shareholders, (ii) to prevent an undue burden on our liquidity, (iii) to preserve our status as a REIT, (iv) following any material decrease in our NAV, or (v) for any other reason.

To learn more about the Income REIT's Share Repurchase Plan, please refer to the section of our full offering circular captioned “Description of Our Common Shares – Quarterly Share Repurchase Program."

Because each investor’s tax considerations are different, it is recommended that you consult with your tax advisor. You also should review the section of the offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in repurchase of shares and liquidating distributions.

Your annual detailed tax information will be reported on Form 1099-DIV, if required, and will be provided to you in electronic form by January 31 of the year following each taxable year.

A liquidity transaction could consist of a sale of all assets, a roll-off to maturity of all assets, a sale or merger of the Company, consolidation with other REITs managed by our Manager, a listing of the Company on an exchange, or any other similar transaction.

The Income REIT does not have a stated term. The Income REIT's Manager has the discretion to consider and execute a liquidity transaction at any time if it determines it is in the best interest of the Company.

Accredited Investors include individuals who meet the following criteria:

- Have a net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

All Other Investors may invest so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons)

The Income REIT focuses on investing in the following types of assets: commercial real estate loan and equity assets, including, without limitation, senior debt, mezzanine debt, junior debt participation, equity interests, including joint ventures and limited partnerships, preferred equity, and other real estate-related assets. We intend to hold at least 55% of the total value of our assets in commercial mortgage-related instruments that are closely tied to one or more underlying commercial real estate projects, such as mortgage loans, subordinated mortgage loans, mezzanine debt and participations, as well as direct interests in real estate that meet certain criteria set by the staff of the SEC.

CUMULATIVE DISTRIBUTIONS

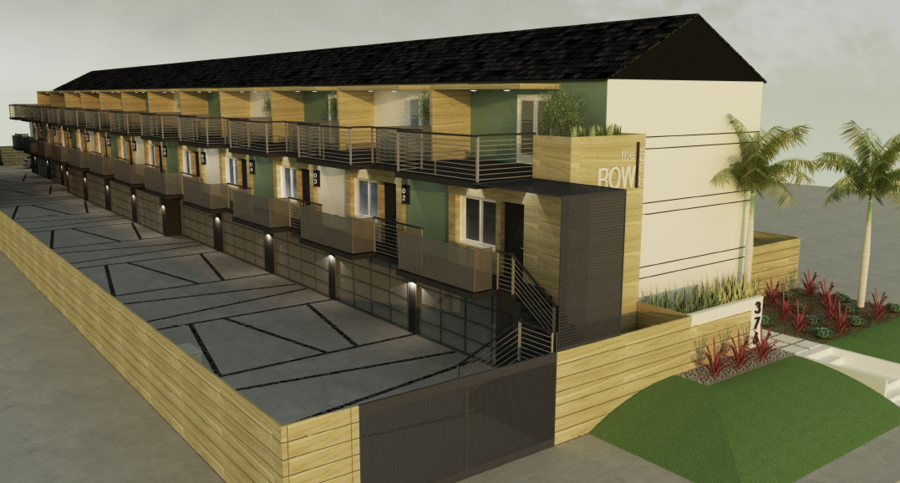

- Multi-FamilyProperties that have five or more residential units in a single building and may be further classified as garden style, low-rise, or high-rise.

- OfficeMid-rise or high-rise, downtown or suburban.

- RetailGrocery-anchored centers, shopping centers, power centers and strip malls.

- Joint Venture EquityInvestors in Joint Venture Equity own an interest in an entity (usually an LLC) that invests in the equity portion of a property. After all debt is paid, and any Preferred Equity distributions are made, the Joint Venture Equity investor receives a pro rata portion of a preferred return, cash flow, and any profits upon sale. Joint Venture Equity is the riskiest investment as it has the lowest priority of distributions, although it has the greatest upside potential.

- Mezzanine DebtSecond in line for repayment are investors in Mezzanine Debt and B Notes. Mezzanine Debt is structured as a loan secured by a pledge of interest in the entity owning the property. In the event of loan default, investors may have the right to foreclose on the interests of the entity and step into ownership of the property, subject to any senior debt. B Notes are secondary tranches of senior loans with an A/B structure, and are secured by the property itself. In the event of loan default, the investors in a B Note may participate in the right to foreclose on the property and receive sale proceeds to repay principal, unpaid interest and any fees, subject to the A Note investor.

- Preferred EquityInvestors in Preferred Equity investments own an interest in the property and have a priority over the other equity investors to receive distributions of cash flow and capital invested. In the event of loan default, Preferred Equity investors may have the right to take over control and management of the property.

| Investment | Location | Property Type | Investment Type | Weight |

|---|---|---|---|---|

| Multiple Cities, TX | Retail | Preferred Equity | 0% | |

| Virginia Beach, VA | Multi-family | Joint Venture Equity | 0% | |

| Columbus, OH | Office | Joint Venture Equity | 0% | |

| Richmond, VA | Multi-family | Joint Venture Equity | 0% | |

| Lubbock, TX | Office | Joint Venture Equity | 0% | |

| Fenton, MO | Multi-family | Joint Venture Equity | 0% | |

| Creve Coeur, MO | Multi-family | Joint Venture Equity | 0% | |

| Vancouver, WA | Multi-family | Joint Venture Equity | 0% | |

| Vancouver, WA | Multi-family | Joint Venture Equity | 0% | |

| Grove City, OH | Multi-family | Joint Venture Equity | 0% | |

| Georgetown, KY | Multi-family | Joint Venture Equity | 0% | |

| Gresham, OR | Multi-family | Joint Venture Equity | 0% | |

| Cincinnati, OH | Mixed-Use | Joint Venture Equity | 0% | |

| Beavercreek, OH | Office | Joint Venture Equity | 0% | |

| Columbus, OH | Multi-family | Joint Venture Equity | 0% |

| Investment | Location | Property Type | Investment Type | Invested |

|---|---|---|---|---|

| Canton, OH | Office | Preferred Equity | 2000000.00 | |

| San Antonio, TX | Office | Mezzanine Debt | 3400000.00 | |

| Centennial, CO | Office | Mezzanine Debt | 2300000.00 | |

| Pensacola, FL | Retail | Mezzanine Debt | 1125000.00 | |

| Suwanee, GA | Office | Senior Debt | 1500000.00 | |

| Jonesboro, GA | Retail | Preferred Equity | 1250000.00 | |

| Corona, CA | Retail | Mezzanine Debt | 3549300.00 | |

| Chula Vista, CA | Multi-family | Senior Debt | 4490000.00 | |

| San Francisco, CA | Mixed-Use | Senior Debt | 4750000.00 | |

| La Habra, CA | Retail | Preferred Equity | 1900000.00 | |

| Tucson, AZ | Multi-family | Preferred Equity | 2275000.00 | |

| Virginia Beach, VA | Office | Preferred Equity | 1700000.00 | |

| Hanford, CA | Retail | Senior Debt | 1900000.00 | |

| Garden Grove, CA | Self-storage | Mezzanine Debt | 3915000.00 | |

| Brooklyn, NY | Mixed-Use | Senior Debt | 1350000.00 | |

| Waterbury, CT | Retail | Preferred Equity | 3000000.00 | |

| Riverside, CA | Office | Mezzanine Debt | 2500000.00 | |

| West Chester, PA | Flex | Preferred Equity | 1450128.00 | |

| Fresno, CA | Retail | Senior Debt | 3600000.00 | |

| Portland, OR | Office | Senior Debt | 3950000.00 | |

| El Paso, TX | Multi-family | Joint Venture Equity | 4748228.00 | |

| Syracuse, NY | Flex | Preferred Equity | 1500000.00 | |

| Las Vegas, NV | Office | Joint Venture Equity | 6000000.00 | |

| Plano, TX | Multi-family | Preferred Equity | 2323030.00 |

The NAV per share calculation reflects the total value of our assets minus the total value of our liabilities, divided by the number of shares outstanding. As with any methodology used to estimate value, the methodology employed calculating our NAV per share is based upon a number of estimates and assumptions about future events that may not be accurate or complete. Further, different parties using different assumptions and estimates could derive a different NAV per share, which could be significantly different from our calculated NAV per share. Our NAV will fluctuate over time and does not represent: (i) the price at which our shares would trade on a national securities exchange, (ii) the amount per share a shareholder would obtain if he, she or it tried to sell his, her or its shares or (iii) the amount per share shareholders would receive if we liquidated our assets and distributed the proceeds after paying all our expenses and liabilities.

You should carefully review the “Risk Factors” section of this offering circular, which contains a detailed discussion of the material risks that you should consider before you invest in our common shares. These risks include the following:

- We have a limited operating history and there is no assurance that we will achieve our investment objectives.

- We may allocate the net proceeds from this offering to investments with which you may not agree.

- This is a blind pool offering as we have not identified all of the investments we intend to make. As such, you will not have the opportunity to evaluate our future investments before we make them, which makes your investment more speculative.

- Our ability to implement our investment strategy is dependent, in part, upon RM Securities’ ability to successfully execute sales of our common shares on the Realty Mogul Platform, as defined below, which makes an investment in us more speculative

- There are conflicts of interest between us, our Manager and its affiliates.

- We depend on our Manager to select our investments and conduct our operations. We pay fees and expenses to our Manager and its affiliates that were determined as between related parties, and therefore we do not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties.

- Our Manager’s executive officers, and key real estate professionals are also officers, directors, managers and/or key professionals of Realty Mogul, Co. and its affiliates. As a result, they will face conflicts of interest, including time constraints and other conflicts created by our Manager’s compensation arrangements with us and other affiliates of Realty Mogul, Co.

- Our Sponsor and Manager sponsors and advises RealtyMogul Apartment Growth REIT, Inc., respectively, a real estate program substantially similar to us, and they sponsor and advise additional companies that may compete with us, and neither our Sponsor nor our Manager has an exclusive management arrangement with us.

- By purchasing common shares in this offering, you are bound by the arbitration provisions contained in our subscription agreement which limits your ability to bring class action lawsuits or seek remedy on a class basis.

- This offering is being made pursuant to recently adopted rules and regulations under Regulation A (“Regulation A”) of the Securities Act of 1933, as amended (the “Securities Act”). The legal and compliance requirements of these rules and regulations, including ongoing reporting requirements related thereto, are relatively untested.

- If we internalize our management functions, your interest in us could be diluted and we could incur other significant costs associated with being self-managed.

- Our Manager may change our targeted investments and asset allocation without the consent of shareholders, which could result in investments that are different from, and possibly riskier than, those described in this offering circular.

- We have paid, and may continue to pay, distributions from sources other than cash flow from operations, including borrowings, proceeds from asset sales or the sale of our securities in this or future offerings, which may reduce the amount of capital we ultimately invest in real estate and may negatively impact the value of your investment in our common shares.

- The internal accountants or asset managers of our Manager or its affiliates will calculate our NAV on a quarterly basis using valuation methodologies that involve subjective judgments and estimates. As a result, our NAV may not accurately reflect the amount that you might receive for your shares in a market transaction.

- Although we presently intend to complete a transaction providing liquidity to shareholders in the future, our LLC Agreement does not require our board of managers to pursue such a liquidity transaction.

- If we fail to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and no relief provisions apply, we would be subject to entity-level federal income tax and, as a result, our cash available for distribution to our shareholders and the value of our shares could materially decrease.

- We may be subject to adverse legislative or regulatory tax changes.

- We will attempt to manage our portfolio so that we are not required to register as an investment company, such as a mutual fund. This may result in us not making potentially profitable investments, or in us disposing of investments at times that we otherwise would prefer to hold those investments.

- The compensation arrangements for our Manager, its affiliates and the personnel of our Manager and its affiliates may provide them an incentive to increase leverage in the Company or its investments, which may increase risk and volatility in the Company’s performance.

- Number of unique investors, consecutive distribution periods, and amount distributed to investors as of March, 2025.

2 Total asset value represents the aggregate value of all underlying properties in the Income REIT based on the most recent internal valuations as of the end of the fiscal quarter upon which our most recently announced NAV per share is based pursuant to our valuation policies provided, however, the values of properties underlying investments acquired since the most NAV per share was announced are based on the most recent purchase prices. The aggregate value of the properties underlying loans and preferred equity investments made by the Income REIT is based on independent appraisals dated within six months of the original acquisition dates by our Manager, Realty Mogul, Co. or Realty Mogul Commercial Capital, Co., as applicable. As with any methodology used to estimate value, the methodology employed by the internal accountants or asset managers of our Manager or its affiliates is based upon a number of estimates and assumptions about future events that may not be accurate or complete. For more information, see the section of our Offering Circular captioned “Description of Our Common Shares – Valuation Policies.”

3 These hypothetical case studies are provided for illustrative purposes only and do not represent an actual investor or an actual investor's experience, but rather are meant to provide an example of the Income REIT's process and methodology. An individual's experience may vary based on his or her individual circumstances. There can be no assurance that the Income REIT will be able to achieve similar results in comparable situations. Hypothetical returns are net of advisory fees and transaction costs; all dividends are assumed to be reinvested monthly. Actual returns may differ materially from hypothetical returns. Hypothetical returns are from the Income REIT's inception date through March 15, 2025. There is no substitute for actual returns. Past hypothetical performance is not a guarantee of future returns.