Barker Pacific Group, Inc., (BPG) is a firm of experienced real estate professionals active in the acquisition, development, property management, asset management, and construction management of major commercial projects. Founded in 1983, it has developed and owned first-class properties located throughout California, including San Francisco, Los Angeles, Sacramento, and San Diego, as well as Austin, San Antonio, Houston, Phoenix, Las Vegas, and South Florida.

BPG's extensive expertise includes the management, acquisition, and development of substantially leased premier office, self-storage, and residential properties located in major U.S. cities. BPG's flexibility and entrepreneurial approach enable the company to find creative solutions for clients and corporate partners, unlocking value and achieving superior risk-adjusted returns for investors and capital partners across a variety of project and investment types as directed by ever-changing market dynamics.

Lease Comparables

| Property Name | Year Built | # of Units | $/Unit (1x1) | SF (1x1) | $/SF (1x1) | $/Unit (2x1) | SF (2x1) | $/SF (2x1) | $/Unit (2x2) | SF (2x2) | $/SF (2x2) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Onyx183 | 1995 | 390 | $1,440 | 602 SF | $2.39 | $1,595 | 912 SF | $1.75 | $2,011 | 1,136 SF | $1.77 |

| The Meadows | 1984 | 100 | $1,195 / $1,395 | 641 SF | $1.86 / $2.18 | N/A | N/A | N/A | $1,395 / $1,695 | 942 SF | $1.48 / $1.80 |

| The Flats on San Felipe | 1985 | 360 | $1,386 | 636 SF | $2.18 | $1,650 | 798 SF | $2.07 | $1,695 | 1,014 SF | $1.67 |

| Summit at Westwood | 1984 | 150 | $1,365 | 677 SF | $2.02 | $1,524 | 812 SF | $1.88 | $1,584 | 910 SF | $1.74 |

| Terrazzo | 1997 | 224 | $1,364 | 669 SF | $2.04 | $1,828 | 1,002 SF | $1.82 | $2,026 | 1,131 SF | $1.79 |

| Polo Club | 1986 | 296 | $1,217 / $1,276 | 411 SF / 603 SF | $2.96 / $2.12 | $1,513 | 765 SF | $1.98 | $1,877 | 917 SF | $2.05 |

| The Lantern | 1983 | 316 | $1,150 / $1,255 | 613 SF / 630 SF | $1.88 / $1.99 | $1,475 | 905 SF | $1.63 | $1,575 | 956 SF | $1.65 |

| Average | 1987 | 262 | $1,304 | 612 SF | $2.16 | $1,597 | 866 SF | $1.85 | $1,732 | 993 SF | $1.77 |

| Chesapeake Apartments (In-Place) | 1984 | 124 | $1,096 | 501 SF | $2.19 | $1,311 | 746 SF | $1.76 | $1,441 | 840 SF | $1.72 |

| Chesapeake Apartments (Post-Reno)(1) | 1984 | 124 | $1,200 | 501 SF | $2.40 | $1,515 | 746 SF | $2.03 | $1,650 | 840 SF | $1.96 |

(1) Post-renovated rents of $1,383/mo between unit types were already achieved by the Seller in 2023.

Sales Comparables

| Property Name | Sale Date | Year Built | # of Units | Sale Price | $/Unit | $/SF | Vacancy | Property Address |

|---|---|---|---|---|---|---|---|---|

| Arbors of Wells Branch | 5/24/2024 | 1986 | 212 | $30,121,843 | $142,084 | $194 | 5.7% | 1831 Wells Branch Pkwy, Austin, TX 78728 |

| 302 North | 4/08/2024 | 1985 | 176 | $25,300,000 | $143,750 | $214 | 13.8% | 302 Apple Creek Dr, Georgetown, TX 78626 |

| Alara-North Burnet | 12/12/2023 | 1983 | 160 | $21,000,000 | $131,250 | $191 | 5.2% | 1735 Rutland Dr, Austin, TX 78758 |

| Treehouse | 9/28/2023 | 1985 | 297 | $48,960,943 | $164,852 | $235 | 18.0% | 2501 Wickersham Ln, Austin, TX 78741 |

| Terrace Cove Apartments | 12/29/2022 | 1986 | 304 | $48,731,000 | $160,299 | $225 | 18.8% | 6201 Sneed Cv, Austin, TX 78744 |

| Mission James Place | 12/12/2022 | 1983 | 283 | $73,923,324 | $261,213 | $300 | 14.9% | 4009 Victory Dr, Austin, TX 78704 |

| Stassney at SoCo | 12/01/2022 | 1985 | 288 | $54,591,783 | $189,555 | $201 | 18.0% | 1800 E Stassney Ln, Austin, TX 78744 |

| Ashford Costa Azure | 11/29/2022 | 1971 | 240 | $46,000,000 | $191,667 | $246 | 14.5% | 1630 Rutland Dr, Austin, TX 78758 |

| The Village at Gracy Farms | 11/08/2022 | 1994 | 308 | $80,000,000 | $259,740 | $288 | 8.7% | 2600 Gracy Farms Ln, Austin, TX 78758 |

| The Vue | 11/01/2022 | 1999 | 156 | $25,000,000 | $160,256 | $175 | 11.6% | 7607 Blessing Ave, Austin, TX 78752 |

| South Congress Square | 9/28/2022 | 1971 | 115 | $39,745,830 | $345,616 | $462 | 500 S Congress Ave, Austin, TX 78704 | |

| Hunt Club Austin | 8/31/2022 | 1986 | 384 | $77,750,000 | $202,474 | $241 | 19.0% | 3101 Shoreline Dr, Austin, TX 78728 |

| Array Apartments | 8/22/2022 | 1973 | 369 | $81,800,000 | $221,680 | $246 | 14.5% | 2101 Burton Dr, Austin, TX 78741 |

| The Tides on North Plaza | 7/06/2022 | 1981 | 420 | $67,500,000 | $160,714 | $214 | 2.4% | 9200 North Plaza, Austin, TX 78753 |

| South Lamar Village | 5/19/2022 | 1981 | 208 | $48,618,908 | $233,745 | $320 | 7.4% | 3505 S Lamar Blvd, Austin, TX 78704 |

| Arboretum Oaks | 5/09/2022 | 1984 | 252 | $69,700,000 | $276,587 | $352 | 2.4% | 9617 Great Hills Trl, Austin, TX 78759 |

| The Hive Red River | 1/12/2022 | 1971 | 138 | $25,250,000 | $182,971 | $295 | 1.0% | 3401 Red River St, Austin, TX 78705 |

| The Grove at Austin | 1/07/2022 | 1973 | 190 | $42,000,000 | $221,053 | $286 | 2.2% | 3707 Menchaca Rd, Austin, TX 78704 |

| Total/Averages | 1982 | 250 | $55,973,243 | $201,332 | $254 | 10.9% | ||

| Chesapeake Apartments (Subject) | 1984 | 124 | $14,850,000 | $119,758 | $187 | 12300 Hymeadow Dr, Austin, TX 78750 |

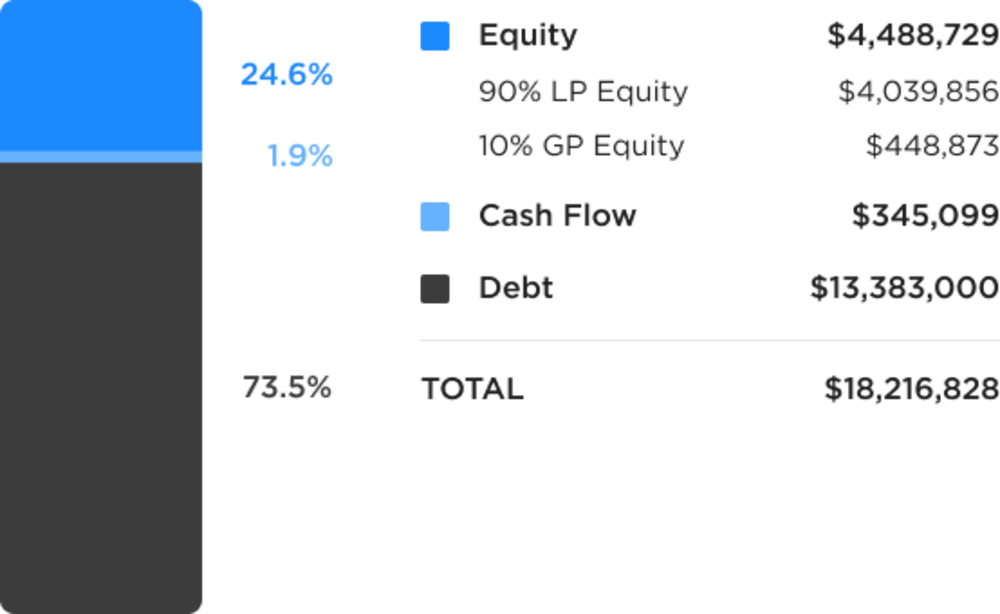

| Sources of Funds | Amount |

|---|---|

| LP Equity | $4,039,856 |

| GP Equity(1) | $448,873 |

| Debt | $13,383,000 |

| Cash Flow | $345,099 |

| Total Sources of Funds | $18,216,828 |

| Uses of Funds | Amount |

|---|---|

| Purchase Price | $14,850,000 |

| Acquisition Fee | $148,500 |

| Closing Costs/Working Capital(2) | $807,930 |

| Refundable Interest Reserves | $1,030,000 |

| Capital Improvements | $1,380,398 |

| Total Uses of Funds | $18,216,828 |

(1) The Sponsor’s equity contribution may consist of friends and family equity and equity from funds controlled by the Sponsor.

(2) Includes fees paid to RM Securities, LLC and RM Technologies, LLC. For more information, please see the Fees and Disclosures sections.

The expected terms of the debt financing are as follows:

Senior Loan

- Lender: Fannie Mae

- Loan Type: Assumed

- Loan Amount: $13,383,000

- Loan Term: 10 Year Term (8 Years Remaining)

- Extension Options: No

- Amortization: Full Term I/O

- Interest Type: SOFR + 230 bps

- Interest Rate: Maximum at 5.3% (1)

- Interest-Only Period: Full Term I/O

(1) Average Index Rate assumes the acquisition of a two-year 3.00% interest rate cap at closing coupled with Chatham’s Term SOFR forward curve as of 9/19/24, which shows the Index dropping below 3.00% during the Sponsor’s projected hold period. Sponsor has also included an allocation for a second two-year rate cap at closing, which will be acquired at a to-be-determined strike at the start of Year 3.

(2) A substantial portion of the total acquisition for the Property will be paid with borrowed funds, i.e., debt. Please carefully review the Disclosures section below for additional information concerning the Sponsors use of debt.

Barker Pacific Group intends to make distributions from Chesapeake Austin Investors, LLC as follows:

- Pari-passu all cash flow available for distribution to the Equity Investors(1) until the Equity Investors(1) receive a Preferred Return of 8.0% IRR;

- 80% / 20% (80% to Equity Investors(1) / 20% to Promoted/Carried Interest) of all cash flow available for distribution until Equity Investors(1) receive a 12.0% IRR;

- 70% / 30% (70% to Equity Investors(1) / 30% to Promoted/Carried Interest) of all cash flow available for distribution thereafter.

Barker Pacific Group intends to make distributions to investors after the payment of the company's liabilities (loan payments, operating expenses, and other fees as more specifically set forth in the LLC agreements, in addition to any member loans or returns due on member loan).

Distributions are expected to start in April 2026 and are projected to continue on a quarterly basis thereafter. Distributions are at the discretion of Barker Pacific Group, who may decide to delay distributions for any reason, including maintenance or capital reserves.

Barker Pacific Group will receive a promoted/carried interest as indicated above.

(1) Equity Investors include all members of the Limited Partnership and General Partnership, including the Sponsorship Group.

You will pay certain fees and compensation over the life of the transaction; please refer to Barker Pacific Group's materials for details. The following fees and compensation will be paid(1)(2):

One-Time Fees:

| Type of Fee | Amount of Fee | Received By | Paid From |

|---|---|---|---|

| Acquisition Fee | 1.00% of Purchase Price | Sponsor | Capitalized Equity Contribution |

| Platform Fee | Flat One-Time Fee of $15,000 | RM Securities, LLC | Capitalized Equity Contribution |

| Placement Fee2 | 4.00% of the Raised Amount up to $2 million, plus 3.50% of the Raised Amount in excess of $2 million. | RM Securities, LLC | Capitalized Equity Contribution |

Recurring Fees:

| Type of Fee | Amount of Fee | Received By | Paid From |

|---|---|---|---|

| Asset Management Fee | 1.00% of Effective Gross Income | Sponsor | Cash Flow |

| Construction Management Fee | 5.00% of CapEx Budget | Sponsor/Sponsor Affiliate | Construction Expenditure Budget |

| Property Management Fee | 3.00% of EGI with a floor of $5,500 per month | Third-Party Management Company or Sponsor if brought in-house | Cash Flow |

| Administration Solution Licensing Fee2 | 1.00% per annum of the aggregate capital contributions of the RM platform investor for whom RM Technologies provides the Administration Solution. | RM Securities, LLC | Cash Flow / Capitalized Equity Contribution |

(1) Fees may be deferred to reduce impact to investor distributions.

(2) For more information on the fees paid to RM Securities and its affiliates or any other fees you will pay in connection with Sponsor’s offering, please carefully review the Sponsor’s Investment Documents. Please also carefully review RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

RM Securities, LLC, its registered representatives, affiliates, associated persons, and personnel of its affiliates who may also be associated with it, including our associated persons and personnel of our affiliates who are also be associated with RM Securities, LLC (it (“RM Securities,” “we,” “our,” or “us”) will receive fees, expense reimbursements, and other compensation (“Fees”) from the issuer of this investment offering, its sponsor, or an affiliate thereof (“Sponsor”), or otherwise in connection with Sponsor’s offering. The Fees paid to us are in addition to other fees you will pay to Sponsor or in connection with Sponsor’s investment offering. You will pay Fees to Sponsor, either directly or indirectly as an investor in the Sponsor’s offering. Sponsor will use the Fees you pay, as well as funds you invest in the relevant offering, to compensate us. The Fees paid to us will directly or indirectly be borne by you as the investor (typically, but not always, in the form of an expense of the Sponsor’s offering in which you invest) because such Fees will reduce the proceeds available for distribution to you and reduce the amount you earn over time.

For more information on the Fees paid to us, or any other Fees you will pay in connection with Sponsor’s offering, please carefully review the Sponsor’s Investment Documents. Please also carefully review RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

No Approval, Opinion or Representation, or Warranty by RM Securities, LLC

Sponsor has provided, approved, and is solely responsible in all aspects for the information on this webpage (“Page”), including Sponsor’s offering documentation, which may include without limitation the Private Placement Memorandum, Operating or Limited Partnership Agreement, Subscription Agreement, the Project Summary and all exhibits and other documents attached thereto or referenced therein (collectively, the “Investment Documents”). The Investment Documents linked on this page have been prepared and posted by Sponsor, and not by RM Securities. We did not assist in preparing, do not adopt or endorse, and we are not otherwise responsible for, the Sponsor’s Investment Documents. We make no representations or warranties as to the accuracy of information on this Page or in the Sponsor’s Investment Documents and we accept no liability therefor. No part of the information on this Page or in the Sponsor’s Investment Documents is intended to be binding on us.

Sponsor’s Information Qualified by Investment Documents

The information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of Investment

This investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor Assumptions

Sponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Neither RM Securities nor Sponsor are obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past Performance

Any description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of Debt

A substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not Registered

Sponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment Advice

Nothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments. For additional information on RM Securities’ involvement in this offering, please carefully review the Sponsor’s Investment Documents, and RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.