Georgetown Partners is a private real estate investment company focused on real estate in the Washington, DC Metro area. Georgetown targets both stabilized and value-add opportunities, which will diversify the investment portfolios for investors. With over twenty years of commercial real estate experience, Georgetown Partners has worked with institutional clients delivering results. Georgetown Partners is a fully integrated company. Georgetown Partners was founded in late 2017 and has a portfolio of multiple assets valued at $40 million with projected stabilized values of $50 million. In addition, to the existing assets under management, Georgetown Partners is acquiring $60 million of multifamily deals under contract in the Washington DC Metro that are set to close in the first two quarters of 2021. As a company, Georgetown Partners is focused on recession-resistant asset classes including medical office and affordable/workforce housing. The principals of Georgetown Partners have depth of experience nationwide across all asset classes.

The Property, located at 13940 Longwood Manor Ct, Woodbridge, VA 22191, is a 138-unit apartment building located just 25 miles Southeast of Washington, DC. The Property comprises a unit mix of 42 one-bedroom and 96 two-bedroom units, across ten buildings totaling 120,630 SF, which sits on nine acres. The Property is currently 96% occupied and has historically touted 95% rent collections that have continued to date. Each unit is separately metered for electricity, and the resident pays for all the utilities.

In-Place/Stabilized Unit Mix:

| Unit Type | # of Units | Average SF/Unit | Avg Rent (In-Place) | Avg Rent (Post-Reno) | Post-Reno Rent per SF |

| Classic | |||||

| 1x1 | 25 | 687 | $1,294 | $1,435 | $2.09 |

| 2x2 | 78 | 956 | $1,496 | $1,636 | $1.71 |

| Renovated | |||||

| 1x1 | 17 | 687 | $1,385 | $1,435 | $2.09 |

| 2x2 | 18 | 956 | $1,553 | $1,636 | $1.71 |

| Total/Averages | 138 | 874 | $1,453 | $1,575 | $1.83 |

| Dominion Middle Ridge | Dominion Lake Ridge | Windsor Park | Averages | Subject (Post-Reno Rents) | |

|---|---|---|---|---|---|

| Year Built | 1990 | 1987 | 1987 | 1988 | 1987 |

| # of Units | 280 | 192 | 220 | 231 | 138 |

| Class | C | C | B | B | |

| Levels | 2 | 2 | 3 | 3 | |

| Occupancy | 92.0% | 99.0% | 99.0% | 96.0% | |

| Distance from subject | 5.9 mi | 6.1 mi | 6.8 mi | ||

| $/Unit (1x1) | $1,448 | $1,440 | $1,425 | $1,438 | $1,435 |

| SF (1x1) | 691 SF | 718 SF | 796 SF | 735 SF | 687 SF |

| $/SF (1x1) | $2.10 | $2.01 | $1.79 | $1.96 | $2.09 |

| $/Unit (2x2) | $1,606 | $1,661 | $1,659 | $1,642 | $1,636 |

| SF (2x2) | 893 SF | 898 SF | 931 SF | 907 SF | 956 SF |

| $/SF (2x2) | $1.80 | $1.85 | $1.78 | $1.81 | $1.71 |

| The Preserve at Catons Crossing | The Glen at White Pines | Abbotts Run | Assembly Manassas | Averages | Subject | |

|---|---|---|---|---|---|---|

| Date Sold | Sep 2020 | Aug 2020 | Sep 2019 | Apr 2019 | ||

| Year Built | 2010 | 1974 | 1988 | 1986 | 1987 | |

| # of Units | 200 | 166 | 248 | 408 | 138 | |

| Class | B | B | B | B | B | |

| Average Unit Size | 922 SF | 1,059 SF | 1,022 SF | 1,100 SF | 1,026 SF | 874 SF |

| Sale Price | $57,000,000 | $34,500,000 | $66,000,000 | $84,396,000 | $60,474,000 | $28,475,000 |

| $/Unit | $285,000 | $207,831 | $266,129 | $206,853 | $241,453 | $206,341 |

| $/SF | $309 | $179 | $262 | $215 | $241 | $236 |

| Cap Rate | 4.50% | - | 4.75% | 5.07% | 4.77% | 5.00% |

| Building Size | 184,418 SF | 192,600 SF | 252,108 SF | 391,916 SF | ||

| Distance from subject | 3.1 mi | 17.0 mi | 11.7 mi | 20.4 mi |

Sale and lease comps were obtained from Georgetown Partners.

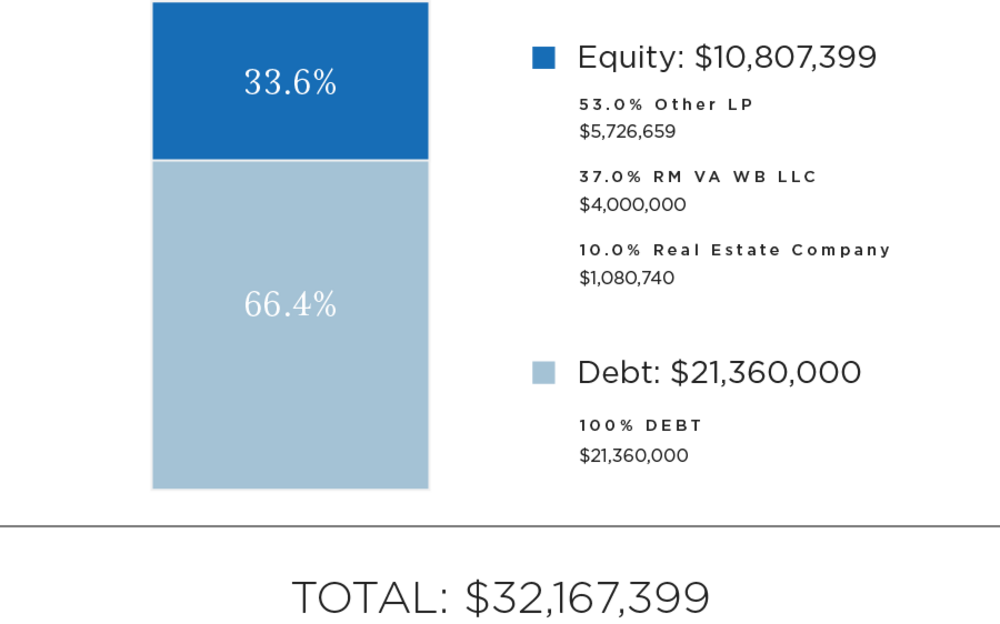

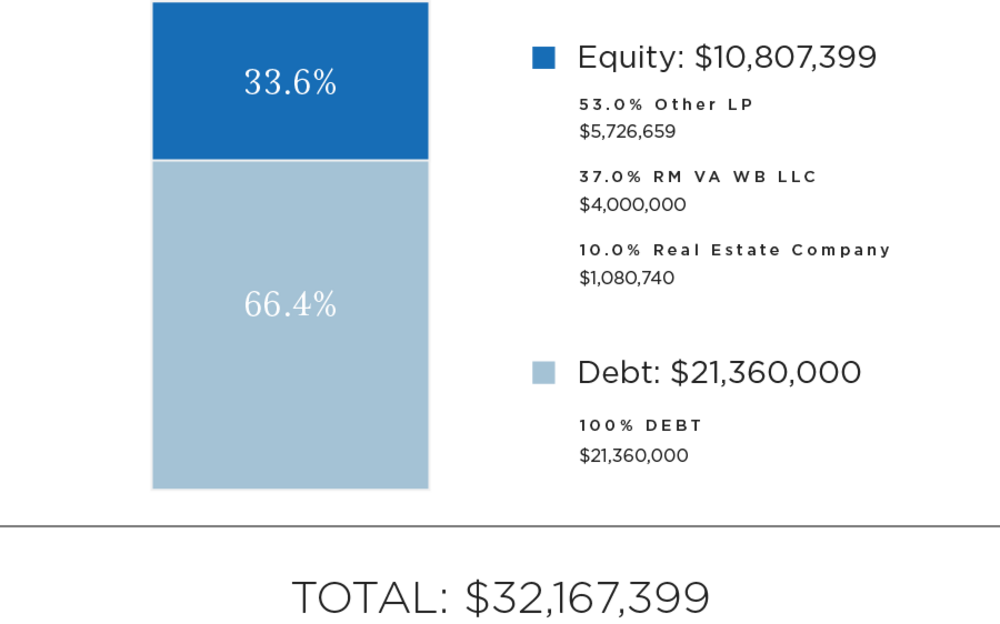

| Sources of Funds | Amount |

|---|---|

| Debt | $21,360,000 |

| Equity | $10,807,399 |

| Total Sources of Funds | $32,167,399 |

| Uses of Funds | Amount |

| Purchase Price | $28,475,000 |

| Acquisition Fee | $284,750 |

| Loan Costs | $339,880 |

| CapEx | $1,027,683 |

| Closing Costs(1) | $398,837 |

| Loan Reserves | $1,641,249 |

| Total Uses of Funds | $32,167,399 |

Please note that the Georgetown Partners' equity contribution may consist of friends and family equity and equity from funds controlled by Georgetown Partners. Additionally, the numbers represented above can change prior to closing depending on final loan proceeds, property condition assessments, appraisals, final closing costs, and other lender-mandated expenses.

(1) RM Technologies operates the RealtyMogul platform. RM Technologies charges a fixed, non-percentage-based fee for real estate companies to use the marketplace. An estimate of this fee is included in the Closing Costs and is intended to be capitalized into the transaction at the discretion of the Manager.

The expected terms of the debt financing are as follows:

- Estimated Proceeds: $21,360,000

- Estimated Annual Interest Rate (Fixed): 3.27%

- Term: 10 years

- Interest Only: 5 years

Supplemental loan:

- Origination Month: Month 36

- Estimated Proceeds: $2,520,000

- Estimated Annual Interest Rate (Fixed): 3.77%

- Interest Only: 2 years

There can be no assurance that a lender will provide debt on the rates and terms noted above, or at all. All rates and terms of the debt financing are subject to lender approval, including but not limited to possible increases in capital reserve requirements for funds to be held in a lender-controlled capital reserve account.

Georgetown Partners intends to make distributions from VA WB, LLC to RM VA WB LLC as follows:

- To the Members, pari passu, all excess operating cash flows to an 8.0% IRR to the Members;

- 90% / 10% (90% to Members / 10% to Promote) of excess cash flow to a 10.0% IRR;

- 80% / 20% (80% to Members / 20% to Promote) of excess cash flow to a 12.0% IRR;

- 70% / 30% (70% to Members / 30% to Promote) of excess cash flow and appreciation thereafter.

VA WB, LLC intends to make distributions to investors. Note that all distributions will occur after the payment of both company's liabilities (loan payments, operating expenses, and other fees as set forth in the LLC agreements, in addition to any member loans or returns due on member loan).

Distributions are expected to start in August 2021 and are projected to continue on a quarterly basis thereafter. These distributions are at the discretion of Georgetown Partners, who may decide to delay distributions for any reason, including maintenance or capital reserves.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Effective Gross Revenue | $2,428,602 | $2,574,837 | $2,700,326 | $2,789,796 | $2,863,441 |

| Total Operating Expenses | $932,456 | $962,221 | $991,794 | $1,013,968 | $1,034,444 |

| Net Operating Income | $1,461,646 | $1,577,426 | $1,672,638 | $1,739,216 | $1,791,653 |

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|---|

| Investor-Level Cash Flows | ($4,000,000) | $376,253 | $392,428 | $1,349,751 | $415,556 | $4,693,463 |

| Net Earnings to Investor - Hypothetical $50,000 Investment | ($50,000) | $4,703 | $4,905 | $16,872 | $5,194 | $58,668 |

Certain fees and compensation will be paid over the life of the transaction; please refer to Georgetown Partners' materials for details. The following fees and compensation will be paid(1)(2)(3):

| Type of Fee | Amount of Fee | Received By | Paid From | Notes |

|---|---|---|---|---|

| Acquisition Fee | $284,750 | Georgetown Partners | Capitalized Equity Contribution | 1.0% of purchase price |

| Financing Fee | 0.75% of loan amount | Georgetown Partners | Capitalized Equity Contribution |

| Type of Fee | Amount of Fee | Received By | Paid From |

|---|---|---|---|

| Administrative Services Fee | 1.0% of amount invested into RM VA WB LLC | RM Admin(3) | Distributable Cash |

| Asset Management Fee | 2.0% of Effective Gross Income | Georgetown Partners | Distributable Cash |

(1) Fees may be deferred to reduce impact to investor distributions

(2) RM Technologies operates the RealtyMogul platform. RM Technologies charges a fixed, non-percentage-based fee for real estate companies to use the marketplace. An estimate of this fee is included in the Closing Costs and is intended to be capitalized into the transaction at the discretion of the Manager.

(3) RM Admin will be providing the following services:(a) responding to inbound investor inquiries regarding how to subscribe to the Project, (b) distribution of all annual tax forms (after receipt of same from Project Sponsor), (c) processing distributions that are payable from RM VA WB LLC to Investors, however, RM Admin will not be deemed to have custody of client funds, (d) distribution of all quarterly reports (after receipt of same from Project Sponsor) and (e) summarizing sponsor information on property performance, responding to investor inquiries regarding sponsor performance information as well as the real estate market generally.

RM Securities, LLC, its registered representatives, affiliates, associated persons, and personnel of its affiliates who may also be associated with it, including our associated persons and personnel of our affiliates who are also be associated with RM Securities, LLC (it (“RM Securities,” “we,” “our,” or “us”) will receive fees, expense reimbursements, and other compensation (“Fees”) from the issuer of this investment offering, its sponsor, or an affiliate thereof (“Sponsor”), or otherwise in connection with Sponsor’s offering. The Fees paid to us are in addition to other fees you will pay to Sponsor or in connection with Sponsor’s investment offering. You will pay Fees to Sponsor, either directly or indirectly as an investor in the Sponsor’s offering. Sponsor will use the Fees you pay, as well as funds you invest in the relevant offering, to compensate us. The Fees paid to us will directly or indirectly be borne by you as the investor (typically, but not always, in the form of an expense of the Sponsor’s offering in which you invest) because such Fees will reduce the proceeds available for distribution to you and reduce the amount you earn over time.

For more information on the Fees paid to us, or any other Fees you will pay in connection with Sponsor’s offering, please carefully review the Sponsor’s Investment Documents. Please also carefully review RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

No Approval, Opinion or Representation, or Warranty by RM Securities, LLCSponsor has provided, approved, and is solely responsible in all aspects for the information on this webpage (“Page”), including Sponsor’s offering documentation, which may include without limitation the Private Placement Memorandum, Operating or Limited Partnership Agreement, Subscription Agreement, the Project Summary and all exhibits and other documents attached thereto or referenced therein (collectively, the “Investment Documents”). The Investment Documents linked on this page have been prepared and posted by Sponsor, and not by RM Securities. We did not assist in preparing, do not adopt or endorse, and we are not otherwise responsible for, the Sponsor’s Investment Documents. We make no representations or warranties as to the accuracy of information on this Page or in the Sponsor’s Investment Documents and we accept no liability therefor. No part of the information on this Page or in the Sponsor’s Investment Documents is intended to be binding on us.

Sponsor’s Information Qualified by Investment DocumentsThe information on this Page is qualified in its entirety by reference to the more complete information about the offering contained in the Sponsor’s Investment Documents. The information on this Page is not complete and subject to change at the Sponsor’s discretion at any time up to the closing date. The Sponsor’s Investment Documents and supplements thereto contain important information about the Sponsor’s offering including relevant investment objectives, the business plan, risks, charges, expenses, and other information, which you should consider carefully before investing. The information on this Page should not be used as a basis for an investor’s decision to invest.

Risk of InvestmentThis investment is speculative, highly illiquid, and involves substantial risk. There can be no assurances that all or any of Sponsor’s assumptions, expectations, estimates, goals, hypothetical illustrations, or other aspects of Sponsor’s business plans (“Assumptions”) will be true or that actual performance will bear any relation to Sponsor’s Assumptions, and no guarantee or representation is made that Sponsor’s Assumptions will be achieved. If Sponsor does not achieve its Assumptions, your investment could be materially and adversely affected. A loss of part or all of the principal value of your investment may occur. You should not invest unless you can readily bear the consequences of such loss. Sponsor’s Assumptions should not be relied upon as the primary basis for your decision to invest.

No Reliance on Forward-Looking Statements; Sponsor AssumptionsSponsor is solely responsible for statements made concerning forward-looking statements and Assumptions, which apply only as of the date made, are preliminary and subject to change, and are expressly qualified in their entirety by the disclosures and cautionary statements included in Sponsor’s Investment Documents, which you should carefully review. Neither RM Securities nor Sponsor are obligated to update or revise such forward-looking statements or Assumptions to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. Sponsor’s forward-looking statements and Assumptions are hypothetical, not based on actual investment achievements or events, and are presented solely for purposes of providing insight into the Sponsor’s investment objectives, detailing Sponsor’s anticipated risk and reward characteristics, and establishing a benchmark for future evaluation of actual results; therefore, they are not a predictor, projection, or guarantee of future results. You should not rely on Sponsor’s forward-looking statements as a basis to invest.

Importantly, we do not adopt, endorse, or provide any assurance of returns or as to the accuracy or reasonableness of Sponsor’s Assumptions or forward-looking statements.

No Reliance on Past PerformanceAny description of past performance is not a reliable indicator of future performance and should not be relied upon as the primary basis to invest.

Sponsor’s Use of DebtA substantial portion of the total cost of the real estate asset acquired by the Sponsor with investor funds (“Property”) will be paid with borrowed funds, i.e., debt. Sponsor’s estimated rates and terms of the debt financing are subject to lender approval, and there is no assurance that the Sponsor will secure debt at the rates and terms presented on this Page or in the Sponsor’s Investment Documents, or at all. The use of borrowed money to acquire real estate is referred to as leveraging, which can amplify losses and could result in lender foreclosure. In addition, if the debt includes a variable (or “floating”) interest rate, the total amount of interest paid over the term of the debt will fluctuate and can increase. As a result, Sponsor’s use of debt can result in a loss of some or all of your investment.

Sponsor’s Offering is Not RegisteredSponsor’s securities offering will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemptions from registration pursuant to Rule 506(c) of Regulation D as promulgated under the Securities Act (“Private Placement”). In addition, the offering will not be registered under any state securities laws in reliance on exemptions from state registration. Such securities (your ownership interests) are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable state and federal securities laws pursuant to registration or an available exemption. All Private Placements on the Platform are intended solely for “Accredited Investors,” as that term is defined in Rule 501(a) under the Securities Act.

No Investment AdviceNothing on this Page should be regarded as investment advice (either with respect to a particular security or regarding an overall investment strategy), a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised to understand and assess the risks associated with real estate or private placement investments. For additional information on RM Securities’ involvement in this offering, please carefully review the Sponsor’s Investment Documents, and RM Securities’ Form CRS, Regulation Best Interest Disclosures, and Limited Brokerage Services Agreement.

1031 Exchange RiskInternal Revenue Code Section 1031 (“Section 1031”) contains complex tax concepts and certain tax consequences may vary depending on the individual circumstances of each investor. RM Securities and its affiliates make no representation or warranty of any kind with respect to the tax consequences of your investment or that the IRS will not challenge any such treatment. You should consult with and rely on your own tax advisor about the tax aspects with respect to your particular circumstances.